April Stock Showers, and Hopefully May Portfolio Flowers

Patience, pruning, and a few fresh seeds for the portfolio.

This month felt like an eternity, at least when looking at my portfolio. It’s so up and down, I can’t help but laugh seeing my portfolio down 10% one day and up 20% the next. Of course, I rest a bit easier knowing I conducted due diligence on all my investments, and I’m comfortable holding them long-term (as long as it takes). It’s also easier when I check my portfolio with intention, not just out of habit. On the extreme down days, I took advantage of closing covered calls to allow for opportunity when my stocks return to normalized levels. I also initiated some new positions in Builder’s FirstSource (BLDR) and Microsoft (MSFT).

I reviewed 5 companies this month:

Nvidia

Qualcomm

G-III Apparel

Visa

Netflix

G-III, Visa & Netflix are all about fairly valued according to my fundamental analysis. Qualcomm offers meaningful appreciation through 2026, and Nvidia looks like the true gem here. I’ll briefly touch on Qualcomm before I dive into Nvidia.

Qualcomm

QCOM is best known for designing the chips and wireless technologies that power most of the world’s smartphones, with a dominant position in 5G modems and mobile processors through its Snapdragon line. But the real story lately has been its push beyond handsets, and into automotive, AI edge computing, and IoT. In early April, the stock popped after announcing a strong pipeline in automotive and AI-powered devices, plus steady licensing revenue that continues to be a quiet cash cow. Despite the cyclical nature of the smartphone market, I believe Qualcomm’s diversification efforts and robust IP portfolio offer meaningful upside into 2026.

The company has a long history of proven profits and strong fundamentals. I choose entries and exits primarily based on current valuation compared to historical values. At 13x 2025 earnings, QCOM is near its typical best entry point on a given year and cheaper than all of 2021 & 2024. Considering its average high PE is 20x, I see the risk/reward skewing upwards from here with a conservative PT of $174 or +18% from today through 2026. I see the ceiling somewhere around $220.

QCOM Best & Worst Buys, Author

Nvidia

Using my valuation analysis before NVDA was as popular as it is today made it one of my all time best investments. The current valuation is near its typical lowest entry point and marking the best opportunity to buy in years. This is a company that generates significant cash flow and earnings on extreme high margins. Without getting into the nitty gritty on their new releases and product lines, it’s obvious based on their customers and sales volume that NVDA is pushing the edge of chip innovation.

Shares trade at about 24x earnings right now against a 5 year average of 58x. While I’m not expecting the company to trade at those levels again, it’s not out of the question considering the median high earnings over the last 4 years is 70x. Also consider they grew EPS at an annualized 91% the last 5 years and are looking toward another 10%+ going forward.

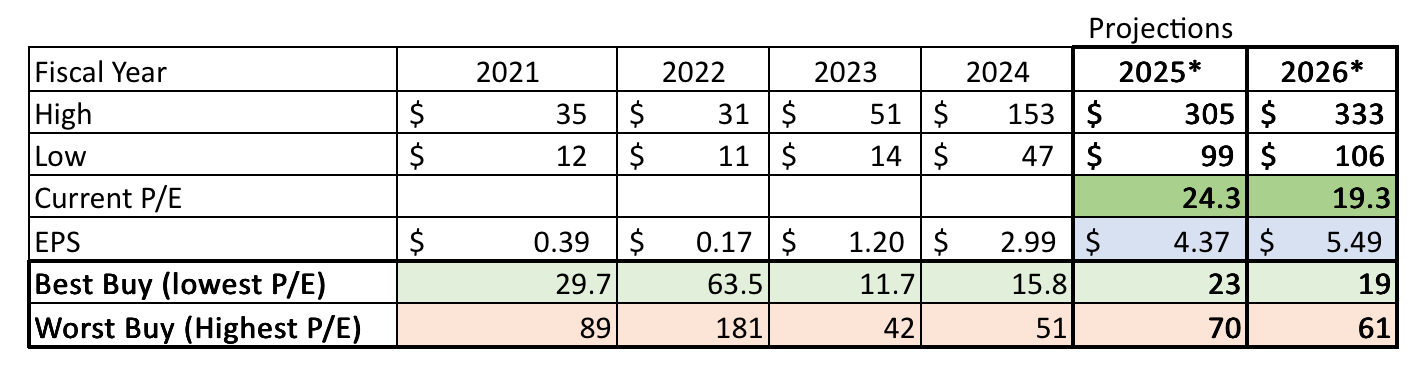

NVDA Best & Worst Buys, Author

Above shows current valuation against best & worst entry points. Below shows the previous 5 year fundamental performance against price movements as well as my next 5 year forecast. Share appreciation at these levels have actually lagged the true value generation of the company when comparing to cash flow & earnings increases.

NVDA Historical & Projected Performance, Author

I set my price targets to a level I comfortably see shares reaching again within the given year. The mid 30x PE range should be an easy target considering NVDA’s lowest high in the last 4 years was 42x. A massive, growing, well-capitalized business trading at these levels is a very nice opportunity.

NVDA Price Targets, Author

That just about sums up what I reviewed this month.

If you’re interested in reading more about NVDA, I have a digestible deep dive I wrote for Valuology & a very comprehensive one on Seeking Alpha:

Valuology: https://open.substack.com/pub/valuology/p/nvidia-a-generational-investment

Seeking Alpha: https://seekingalpha.com/article/4774755-nvidia-a-generational-investment-with-asymmetric-upside

The market is crazy right now, but honestly whether it’s domestic or international, there is always something going on. When you’re plugged in every day, it feels like the most earth shattering thing is happening. The best advice is what we hear the most...

-Invest only what you can so you’re not forced to sell in a down market

-Don’t sell low & buy high

-If you didn’t look at your portfolio for 10 years, and suddenly open your brokerage account, this period will look smoothed out and stocks will have outperformed bonds/CDs/savings accounts

Thanks! Feel free to comment & share with someone who will enjoy!

I am long NVDA, MSFT, and BLDR at the time of writing. This newsletter is for informational and educational purposes only and does not constitute financial advice. All opinions expressed are my own. Please do your own research before making any investment decisions.

Brilliant title💡